Quadrant F

How did we miss that? Frauds, scams and Ponzi schemes

Definition

The risk of criminal elements stealing your money, health, possessions, identity, data, reputation or future.

Criteria

This is the domain of Frauds, Fakes, Flimflammers, Impostors, Schemers, Scammers, Swindlers, Sharks, Scoundrels, Cheaters, Charlatans, Connivers, Cons, Crooks, Quacks, Rogues, Racketeers, Rascals, Mountebanks, Malefactors, Miscreants, Ponzi’s, Black Hats, Bait-and-Switchers, Hustlers and Villains.

Distribution(s)

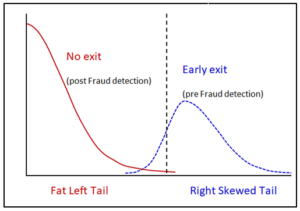

QF has two distinct distributions; a heavily right-tailed distribution applies before the fraud has been exposed (essentially everyone who invests in a fraud and exits early makes a profit – the blue line below), and a fat left-tailed distribution (the red line) for those left holding the bag when the music stops. And litigation may turn the right tail into a left tail if prosecutors force those who exited early to return proceeds under bankruptcy laws.

Examples

- Theranos – Elizabeth Holmes, a young Stanford dropout and budding biotechnopreneur, formed Theranos, a privately held health technology company, whose goal was to provide fast, inexpensive, non-invasive (a finger prick) and accurate blood analysis using small, proprietary automated hardware devices. The company raised US$ 1.4B from 16 investors, leading to a US$10B valuation in 2014. The technology didn’t work, blood samples were run on third-party machines, many clients/patients received dangerously inaccurate blood analysis results and investors lost everything. Data was not peer-reviewed or clinically verified. The SEC charged Theranos, Elisabeth Holmes and President Sunny Balwani with “massive fraud” in 2018 and the company ceased operation shortly thereafter. The fraud persisted due to blind faith and the lack of basic due diligence.

- Wine fraud – Rudy Kurniawan developed a reputation as one of the world’s preeminent connoisseurs and dealers of French Burgundy wines in the late 1990’s. Despite spending millions of dollars on wine, Kurniawan was a counterfeiter, filling old bottles with less expensive new or old wines (often mixing multiple wines to develop a believable match to the original), counterfeiting labels, corks, capsules and bottles. Kurniawan’s fake wines sold for US$ 35.3M at auction in 2006, including eight magnums of 1947 Chateau Lafleur. Sotheby’s learned that only five magnums of the ’47 Lafleur were produced and that was the beginning of the end for Kurniawan. In 2012, FBI agents raided Kurniawan’s home and found all the tools and materials necessary for counterfeiting wine. He was sentenced to 10 years in prison in 2013 and was released in November 2019.

- Investment Ponzi scheme – Bernie Madoff ran a Ponzi scheme from the early 1980’s where the “investments” received from foundations, trusts and acquaintances were used to pay back early investors. The $30-65 billion hole was the largest Ponzi loss in history and netted Madoff a 150 year prison sentence. Family and friends performed compliance and auditing roles and Madoff purportedly exited all positions at the end of each month to avoid Sec reporting requirements. His strategy was to be long (buy) about 1/3 of the Securities in the S&P 100 index, sell out-of-the money index calls and buy out-of-the money index puts. He referred to the strategy as a “split-strike conversion.” This author, with his skilled quant sidekick, tried to replicate the strategy in 2007 and determined that it could not have generated the returns claimed without a time machine. Many had raised the possibility of a Ponzi scheme for years, yet no one – as Harry Markopolous documented – would listen, especially the SEC. The end came during the 2008 GFC when Madoff didn’t have enough cash to satisfy redemptions.

Tools of the Trade – The 11 methods fraudsters employ to lure you in (not in any particular order)

1. Attempts to gain your trust

- By appointing big names to the board (Corporate Heads, Government officials, Scientists and Professors) and enlisting famous people (actors and musicians) as spokesmen. We tend to trust those who have achieved success. And the big names and famous people are often too flattered by the attendant publicity to verify the legitimacy of the company/product/claim.

- Through friends and relatives. Familiarity and friendship encourages us to let our guard down and substitute scrutiny with hope and belief.

- By overstating their abilities and accomplishments and by implying extensive subject-matter expertise. We have a general desire to believe stories and rarely suspect that we may be engaging a charlatan.

- By their confidence, sincerity, charming disposition, charismatic delivery and good looks.

2. In-house verification

- Accountants and auditors are friends, family or non-arms-length. Financial ledgers are a closely held secret. Two sets of books are a dead giveaway (though confirming the existence of that second set may be somewhat difficult).

- Client names and sales receipts are not disclosed since they maybe bogus or a fraction of what has been represented.

- Unaudited assets. How often do we read of low or no gold/trees/oil?

- Industry-standard quality control verification denied.

- In-house verification leads to fake products, fake inventory, fake sales, fake trees, fake minerals, fake books, fake profits, fake bank accounts…

3. Appeals to your catch-the-wave emotions

- Cutting-edge technology

- The next big thing

- Once-in-a-lifetime opportunity

- Never before, never again

- Help to change the world

4. Create a false sense of urgency.

- The opportunity – in its current form – is available for only a short time, so performing Due Diligence, looking too closely under the hood or peeling back the onion skin means you might miss the deal.

- The urgent need for money or commitment is one of the two Red Flags of Fraud according to Frank Abignale (the inspiration for the movie Catch Me If You Can and the TV series White Collar).

5. Your Personal Details ab initio

- Admission to the exclusive Club means providing Personal and financial data “to confirm your information” before any details of the investment or scheme is disclosed.

- The request for personal details is the second of Frank Abigale’s two Red Flags of Fraud.

6. Something for Nothing

- High return, low risk, no risk or a guaranteed return.

- The fraudsters play on our gullibility. We can’t resist something for nothing (or for very little).

- If it seems too good to be true, it probably is.

7. Blind Faith

- Investing in a concept where few details are provided (or available).

- Details are dismissed/avoided since they are too complicated, proprietary, unimportant or just noise.

- You wouldn’t want to miss the forest for the trees.

- Not uncommon in the VC investment space, so not all instances of blind faith are precursors of fraud.

8. Exclusivity

- Few people know about this. It’s our secret.

- You are being given a unique and limited opportunity and you must not discuss this with others for fear of losing the exclusivity.

- Hot tip

9. Guilt trip

- Psychological manipulation or coercion.

- Your caution will be your downfall.

- Your lack of trust will result in missed opportunities.

10. Embarrassment

- We don’t like to admit we’ve been taken advantage of. With hindsight, a scam becomes obvious and others who are presented with the full story might consider us silly, stupid or careless.

- So we tend not to report scams, which allows their propagation.

11. Intimidation and Fear

- Use of aggressive tactics to intimidate, harass and silence sceptical and whistle-blowing employees and independent (external) journalists, investigators and critics

- Invoke pledges of unwavering corporate loyalty among employees, advisors and Board members

- Extensive use and enforcement of NDA’s (Non-disclosure agreements).

- Threats of violence, lawsuits or arrest

- Ransom payments to release data, avoid/remove computer viruses or retrieve any animate or inanimate object